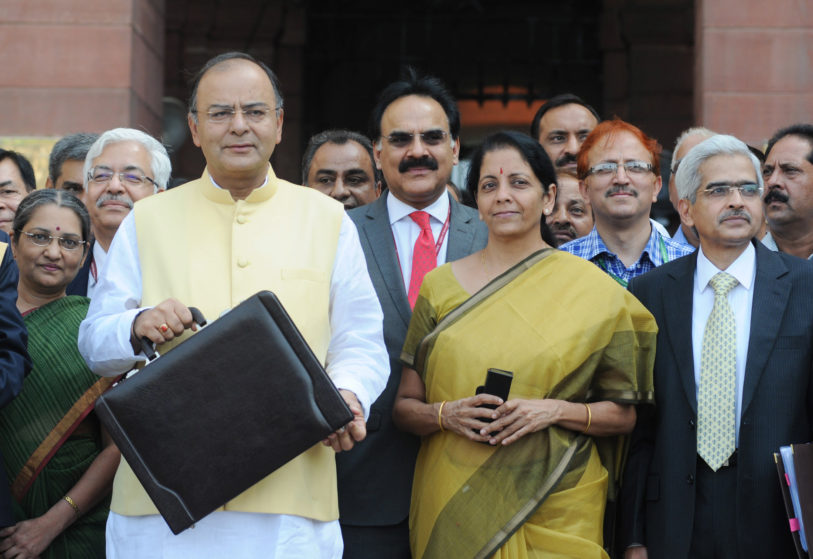

Union Budget 2017 – 18: Union Finance Minister Arun Jaitley is all set to present the 2017 Budget on February 1st. Now with less than a week to go for the Financial Plan, Jaitley might come up with various clauses and amendments related to a number of Acts. The speech is expected to include topics from Demonetisation to Startups. The budget, according to Jaitley, is aimed at benefiting all the individuals of the Country.

What can we expect in the speech?

Goods and Services Tax:

While the new deadline of April for GST is nearing, the new indirect tax system is yet to be planned properly. FM Jaitley is expected to announce the implementation schedule for 2017-18 in the budget session. This tax system will bring together the common national market, reduce the fiscal barriers and also patch local and central duties like excise into a single system.

Demonetisation:

The sudden announcement of Demonetisation received mixed reactions from the citizens of India, while some received it with open arms, some showered criticisms over the move. The Centre is planning final touches to this move by discouraging the use of cash. To compensate, the finance minister is expected to announce tax rebates, incentives and plans to increase the use of digital economy. Experts also believe the FM may announce cash tax rebate over a certain limit of deposits and transactions in banks.

Corporate Tax:

It is expected that the government will cut the corporate tax rates by 1.25-1.5% and bring it down to 28.75-28.5% in the 2017 budget session.Though the move was initially announced in 2015 by the Finance Minister the complexities involved, layers of exemptions and sops over years make it difficult to implement.

Income Tax:

Apart from GST and Corporate taxes, the direct tax is also expected to be in focus this year’s budget speech. Some huge announcements like income tax slabs and rates are also expected in the 2017-18 budget. The FM might raise the tax breaks on money in fixed deposits, mutual funds and insurance premiums from Rs. 1,50,000 to Rs. 2,00,000 a year under Section 80 C scheme. It is hoped to encourage people to make more deposits than piling up cash at home or other places.

Agriculture:

Another expectation of this budget session is measured so as to minimize the demonetization burden on the farmers. The farmers have been left with little to no cash to buy the seeds for their next crop and also for the middle of the sowing season. The government data show more sowing in 2016 than the previous year. Also, the government has waived off interests for 60 days on existing loans on the farms for both Kharif and rabi crops.

Startups:

The 2017 budget is also expected bring in some relief and good news for startups. The finance minister is expected to announce initiatives that will aid the Country’s startups. This also includes increasing the spectrum of the tax free regime from three years to five years and also faster clearances. This move of extending tax free years from three to five years will be announced after the Prime Minister announced ‘Start-Up India’ a year ago in New Delhi.

Railways:

From 2017, the Railway budget will be included in the union budget. This is a clear indication wherein the Central Government decided on freezing state owned organizations from dealing with finances and political influences. The combined budget can only mean that the Indian Railways can avoid funds for dividends of Rs.10,000 crores every year. But so as to fulfill the required budget travelers have to pay more for tickets as railways might impose a separate cess on train tickets so as to provide Rs 1.20 lakh crores to the Rashtriya Rail Sanraksha Kosh which is a safety fund provided to all individuals.

All in all, it is interesting to look forward to what Arun Jaitley will include in this 2017-18 budget session.

Subscribe to our email newsletter to get the latest posts delivered right to your email.

Comments